All-in-one program covering all aspects of business acquisitions and sales in one place.

This is one of the highest-quality mergers and acquisitions courses available globally.

It covers the full deal cycle from both buy-side and sell-side perspectives.

Developed by experts who have executed over $5 billion in public and private market deals across 15+ industries worldwide.

It provides in-depth, high-quality practical insights into every aspect of M&A, from deal search and analysis to negotiation, execution, closing, and integration.

Gain the skills to execute deals at the level of top M&A professionals worldwide.

Life-Changing Program

Life

Transformation

This course can transform your life by teaching you how to acquire businesses (even with little capital if seller-financed).

This opens the door to owning 7-figure businesses and beyond, which you can continue to grow and develop.

Avoid Costly

Mistakes

Avoid costly mistakes that could cost you tens of thousands, or more, by applying proven methods you will master in this course.

Learn to identify red flags, negotiate effectively, and ensure successful deal closure.

Full

Guide

Everything you need to master business acquisitions and sales in one course.

Learn how to identify, evaluate, negotiate, and execute deals, manage due diligence, and close transactions successfully.

Practical

Insights

You can immediately apply the concepts you learned to real business acquisitions and sales.

Overcome challenges with proven, results-driven strategies for successful deal-making.

Step-by-Step

Approach

Clear, actionable lessons to simplify complex M&A concepts.

Follow a structured, step-by-step process to mastering business acquisitions and sales.

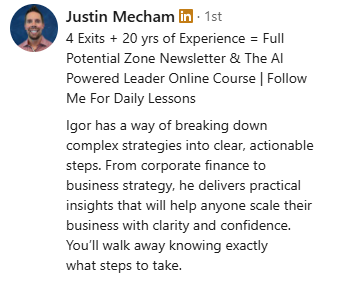

Taught by

Leading Experts

Learn strategies from top M&A experts who have executed billions in deals.

Gain invaluable insights from leading professionals in deal execution.

Real-World

Results Focus

This course tackles real M&A challenges and delivers practical solutions for measurable success.

We only share strategies that work in the real world.

Unique Skills for

Entire Life

Access exclusive M&A insights you won’t find anywhere else.

The skills you gain will serve you for a lifetime, equipping you for long-term business success.

About the Author

Course in Numbers

Course Outline

• Learn what will be covered in the course.

• Introduction to M&A and its key concepts.

• How to approach the course for maximum benefit.

• What to expect from both buy-side and sell-side perspectives.

• Learn how to initiate successful M&A deals.

• Understand the three key deal initiation approaches.

• Gain insights into how to uncover promising M&A opportunities.

• Dive into practical strategies to kickstart your M&A journey.

• Learn the key steps of the initial deal evaluation phase.

• Cover all relevant aspects of this deal stage, from receiving the teaser to preparing the non-binding offer.

• Understand how to evaluate M&A opportunities, including company valuation, modeling, business analysis, etc.

• Learn about all key documents received at this stage and how to analyze them.

• Gain insights on how to build a strong case for your offer.

• Master how to navigate the complexities of the M&A process to avoid early-stage pitfalls.

• Learn how to navigate the detailed deal evaluation phase.

• Gain insights into assembling the right team of financial, legal, and tax advisors.

• Learn how to manage the due diligence process with specialized advisors.

• Discover how to use the Virtual Data Room and perform detailed analysis.

• Learn how to conduct thorough financial, tax and legal due diligence.

• Explore additional due diligence areas, such as technical, commercial, etc.

• Learn how to prepare a compelling binding offer.

• Learn how to navigate the negotiation phase of the deal.

• Discover how to use term sheets to align key aspects of a deal early in the process.

• Gain insights into reviewing and negotiating essential transaction documentation.

• Dive into the intricacies of Sale and Purchase Agreements (SPA) and their critical role in M&A transactions.

• Explore Shareholders' Agreements (SHA) and understand their vital role in managing shareholder relations and corporate governance.

• Learn how to approach commercial deal term negotiations, handle warranties and indemnities, as well as other key arrangements.

• Explore various other deal-related terms in relation to this phase, as well as complementary documentation and items.

• Learn how to navigate the post-signing phase leading up to the closing of an M&A transaction.

• Understand the significance of regulatory filings and clearances in the deal process.

• Gain insights into managing conditions precedent, such as approvals and notifications.

• Discover how to execute the closing process, including the transfer of ownership and funds.

• Learn how to ensure compliance with all transaction terms and conditions to successfully close the deal.

• Gain insights into the preparation and execution of additional documents and other important aspects of this phase.

• Learn how to handle critical post-closing activities following the M&A deal.

• Gain insights into fulfilling post-closing obligations, including preparing closing accounts, making notifications, and settling payments.

• Explore strategies for successful business integration and capturing synergies.

• Gain insights into managing transitional services to ensure smooth business operations.

• Dive into the sell-side perspective of an M&A deal.

• Learn how to initiate a successful sell-side M&A process.

• Discover how to prepare essential materials such as teasers, information memorandums, process letters, and NDAs.

• Gain insights into the process of assembling a team of financial, legal, and other advisors.

• Learn how to manage the virtual data room (VDR) and organize crucial documents for due diligence.

• Discover how to shape and negotiate transaction documentation, such as the sale and purchase agreement (SPA).

• Gain insights into leveraging warranties and indemnities insurance to limit exposure.

• Understand how to manage closing requirements and fulfill conditions precedent to finalize the deal.

• This chapter concludes the course emphasizing the core principles and strategies discussed.

• Review the key takeaways and valuable lessons gained throughout the course.

• Finish the course with actionable insights to drive your success in deal execution.

Testimonials

Who This Program Is For?

Not everyone is the right fit for our courses

This Course is for you if...

You want actionable, real-world insights from M&A experts and entrepreneurs who have bought and sold 8-, 9-, and even 10-figure businesses.

You want to acquire valuable, lifelong skills that will empower you to make smarter business decisions with actionable strategies you can implement right away.

You are looking for a structured, no-fluff approach to successfully acquiring and selling businesses, using proven strategies.

You are looking for comprehensive guides that simplify complex M&A concepts, providing you with clear, actionable steps.

You know success takes time, and you are ready to put in the work, staying persistent until you achieve your goals.

You want exclusive insights you won’t find anywhere else - insights that will deliver one of the highest ROI investments in your life.

You take action, refuse to let obstacles hold you back, and keep moving forward, no matter the setbacks.

You are ready to reassess your strategy and pivot when necessary, ensuring your actions align with your long-term success.

This Course is not for you if...

You are looking for "quick fixes" and "get rich fast" solutions – this is not what we offer - our courses provide proven, real-world solutions that require time and effort.

You prefer doing things "your own way" and are unwilling to consider outside feedback – we focus on proven systems that work, not personal egos.

You expect our courses to tell you what to do every single minute of the day – we share proven strategies that work, but you need to plan your actions based on your unique situation.

You are not ready to take responsibility for your results – success requires you to own your actions, learn from failures, and keep going.

You are not willing to invest in your growth – then our courses are not for you, but remember that Warren Buffet said: "The most important investment you can make is in yourself."

You think simply buying a course guarantees results – we cannot guarantee success or earnings, but we provide all the necessary knowledge - it is up to you what you do with it.

You don't want to make tough decisions or face uncomfortable truths – the only way to succeed is to make difficult choices.

You expect a “magic bullet” to easily solve all your problems – that's not how it works, you need to get your hands dirty.

Who Are Our Students?

Pricing

Wild Capital Academy:

$1 Billion Business Acquisitions

- 30+ topics in video lessons and presentations

- 100+ practical resources, tools and infographics

- Access to our proprietary investor database

- Access to my top-rated M&A book

- Additional templates and case-studies

- Access to practical exercises for each topic

- Regular material updates and new perks

- Discounted access to Wild Capital Academy

Or Join Wild Capital Academy:

GET ACCESS TO:

- ✔ All my courses

- ✔ Exclusive community

- ✔ Interactive challenges

- ✔ Proprietary investor database

- ✔ Live group Q&A calls with Igor

- ✔ Guest lectures with top experts

- ✔ Exclusive deals and opportunities

- ✔ Unique networking platform and events

In total over $20,000 worth of valuable resources

Each member is vetted by our founder through 1:1 entry interviews after submitting the application form. We regularly raise prices to reflect growing demand. Apply now to lock in the best rate for our next opening.

Q&A

• The price secures 1-month access to the course, which should be enough to cover course materials.

• This fee structure ensures you stay engaged and use the program rather than just buying and forgetting.

• We regularly raise prices to reflect growing demand. Secure your spot today to lock in the current rate.

• High ROI incomparable to other courses or educational programs.

• Gain top-tier educational materials tailored for real-world impact.

• Access exclusive insights not found elsewhere.

• 100+ practical resources to ensure your success.

$1 Billion Business Acquisitions Course

• Covers every aspect of M&A, from deal search and analysis to negotiation, execution, closing, and integration.

• 30+ topics covered in video lectures and presentations.

• New content uploaded on an ongoing basis.

Additional Resources

• 100+ additional materials including my book, investor database, worksheets, templates, resources, guides etc.

We are happy to help with whatever questions you have! You can submit a customer support ticket here: https://wildcapital.co/pages/contact